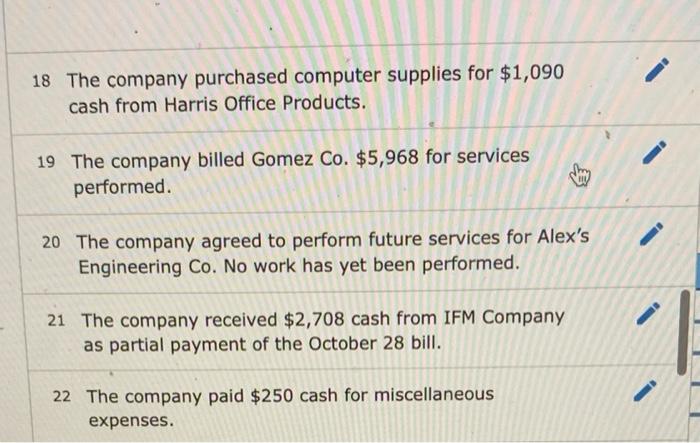

In the real estate it is all on buying low and offering highest but searching for people reasonable-priced characteristics would be hard. As a result of this real estate investors are always remaining a keen attention away getting hidden treasures also known as pre foreclosure.

Invelo

When you look at the a home it is all regarding the to find low and you will promoting high however, shopping for people lowest-valued properties will likely be tough. For that reason a house dealers are often keeping an enthusiastic attention out to possess undetectable gems known as pre property foreclosure.

An educated selling into the home are those that will be charged lowest, who is fit, and this no-one otherwise is aware of. Usually pre foreclosed services view all of those Quinnipiac University loans boxes. But rather than foreclosed home and normal residential property, pre foreclosures are not listed obtainable the customers may not be also looking for a purchaser on the. So how do you look for these undetectable jewels when they are thus cleverly invisible? How does that also buy a great pre foreclosure anyway?

Continue reading for additional info on exactly what pre foreclosures is, an educated a way to locate them and make contact with their people and the way to contain the price.

What is actually A Pre Property foreclosure?

The path to foreclosures try an extended one that can take many years accomplish. Whenever a resident drops on crisis and should not make their home loan repayments the bank will usually proceed to have the foreclosures processes started after a few weeks off overlooked costs. Constantly because the bank notifies the new resident you to foreclosure process commonly start he’s a-flat amount of months, 120 approximately normally, to try and visited a contract locate right back to the tune. At that time the home might be sensed from inside the pre foreclosures. The fresh foreclosures hasn’t began however it is certain.

In these cases this new homeowner does not have any a huge amount of options because it’s unlikely that they’re going to suddenly find a way to make money. During this period home owners are concerned with and work out payments and you will staying their residence, perhaps not placing the house on the market. Within condition you’d select the situation making an effective slope to buy their residence, fulfilling the loans with the financial before foreclosure processes can be also start.

Why are They Trendy?

Pre foreclosures services is actually fashionable assets since the always a genuine home buyer could possibly get all of them for less and never have to vie up against a great many other customers. As the pre property foreclosure aren’t reported available, in the event that a trader discovers you to definitely they will certainly be truly the only you to negotiating into the citizen. And since of your serious state this new homeowner will likely offer for less whether it means getting out off significantly less than a foreclosures and you will paying down the personal debt for the financial.

Pre property foreclosure also are fashionable since they’re in the beginning of foreclosures processes and may also not have fell to your severe disrepair yet ,. One of the biggest dangers of to find an effective foreclosed home is that it is more than likely in the disarray that have high priced solutions necessary before it can be populated once again. Pre foreclosure was home in the very beginning of the techniques and you can might not be when you look at the due to the fact bad from contour.

Expert Suggestion: This is the time to view a house investing, and you will knowledgeable a residential property investors play with Invelo to find prospects, carry out guides, tune revenue and you will work with paigns.

What are the Risks?

To order a house any kind of time phase of foreclosure processes will usually come with related dangers. Even when to shop for a pre foreclosures it’s also possible to bite from significantly more that you could chew having undetectable will cost you and you may high priced fixes. Given that people had issues investing their mortgage it almost certainly don’t have the money to keep track repairs and you can maintenance out of your house for a while. This can imply that you can find major problems that have to become treated through to the household are going to be turned and offered once again. These issues may not be apparent when looking from the home assuming a trader did not carry out the homework it can also be sneak up on them adopting the sale has been finished.